As You grow

___20 years old ___40 years old

___60 years old___80 years old

Are you celebrating your financial independence day?

Independence day?

Every year? from which age?

What does Independence mean to you?

Lagan se mukti ?

Demography of India:

| Generation Alpha | Born 2012 onwards | |

| Generation Z | People born between 1997 to 2012 | |

| Generation Y (millennial) | People born between 1981-1996 | |

| Generation X | People born between 1965 to 1980 | |

| Ageing population |

- Longevity: An increasingly aging population,

- Rising healthcare costs and

- long-term low-interest rates,

- Shifting from joint family to nuclear family

- Rising external debts

- Women live longer than man

- Lack of pension scheme:

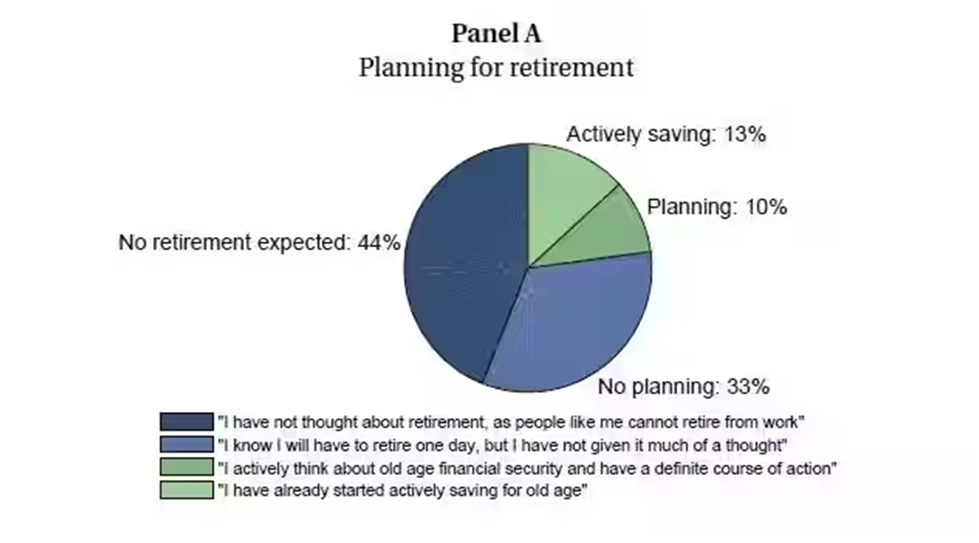

Why there is a need for Retirement Planning: Reports of Household Finance Committee: RBI

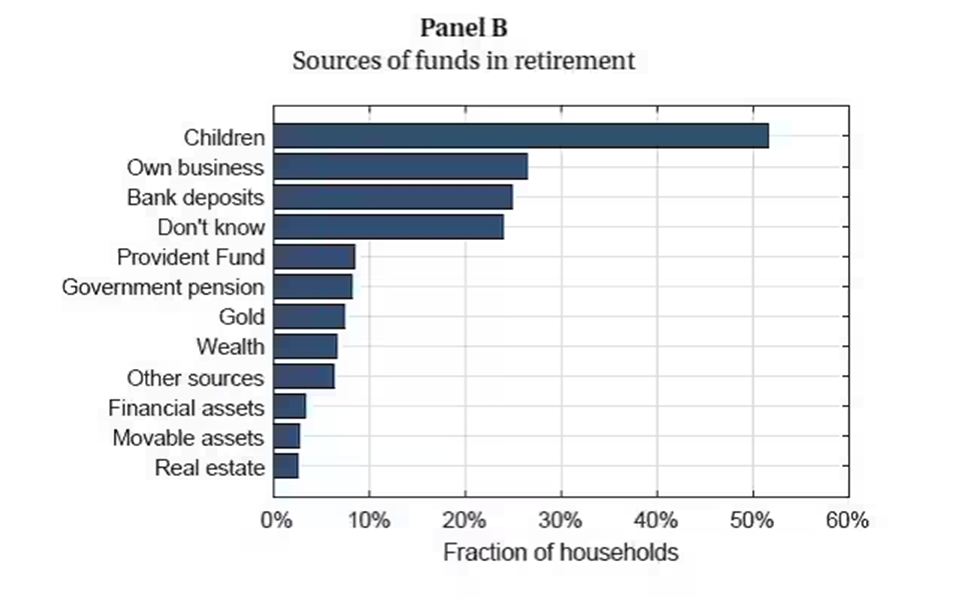

Funding for retirement:

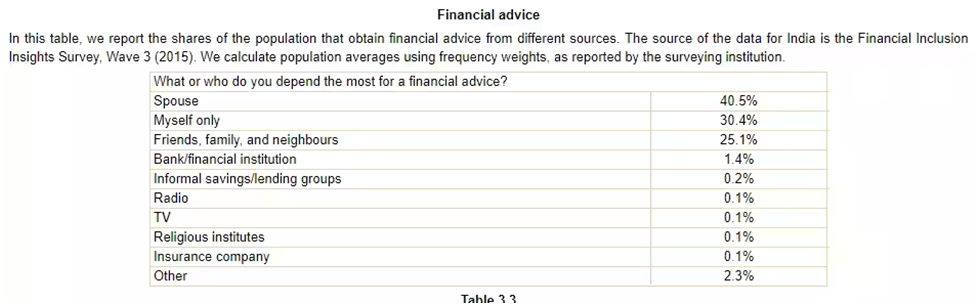

Financial advice people seek from:

LET US BEGIN THE FIRE MOVEMENT:

Financially Independent to Retire Early When you are young, retirement might not seem like something to worry about. The retirement age in India varies between 60 and 65 years. So, you will work all your life, and then one day, your employer will say, “Thank you so much. Your services are no longer required.” And then you will live the rest of your life with the money you saved up. Sounds simple, until you realize that it does not leave much room for living your life. What about your aspirations—the books you wanted to read, the paintings you wanted to make, the vacations you wanted to go on? This is where the idea of early retirement arises.

A change in perspective

To retire early, you first need to change your perspective. You must believe that retirement means not the end of your career but the beginning of your life. So, do not wait to retire when you are old; do it when you can afford it. If you want to retire at 40, the target should be to achieve financial freedom.

What is financial freedom?

It is a stage of life where you do not have any debts and have enough savings to lead a comfortable life. Financial freedom allows you to get a job that you love or not work at all. A popular concept to achieve that goal is Financial Independence Retire Early (FIRE).

How much money should you have post-retirement?

This can be answered with the idea of a safe withdrawal rate, a formula introduced by William Bengen in 1994. It is known as the 4% rule. According to him, your retirement fund should be 25 times your annual expenses, which allows you to withdraw 4% from the fund every year. This shows how much money you would need when you retire. By saving up to 70% of their annual income, FIRE proponents aim to retire early and live off small withdrawals from their accumulated funds.

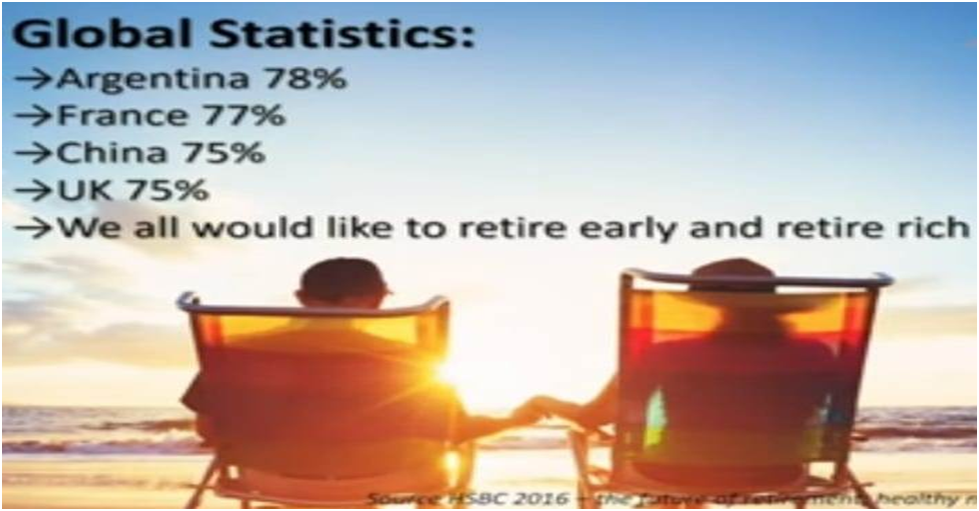

The Future of Retirement Shifting Sand: Reports of HSBC

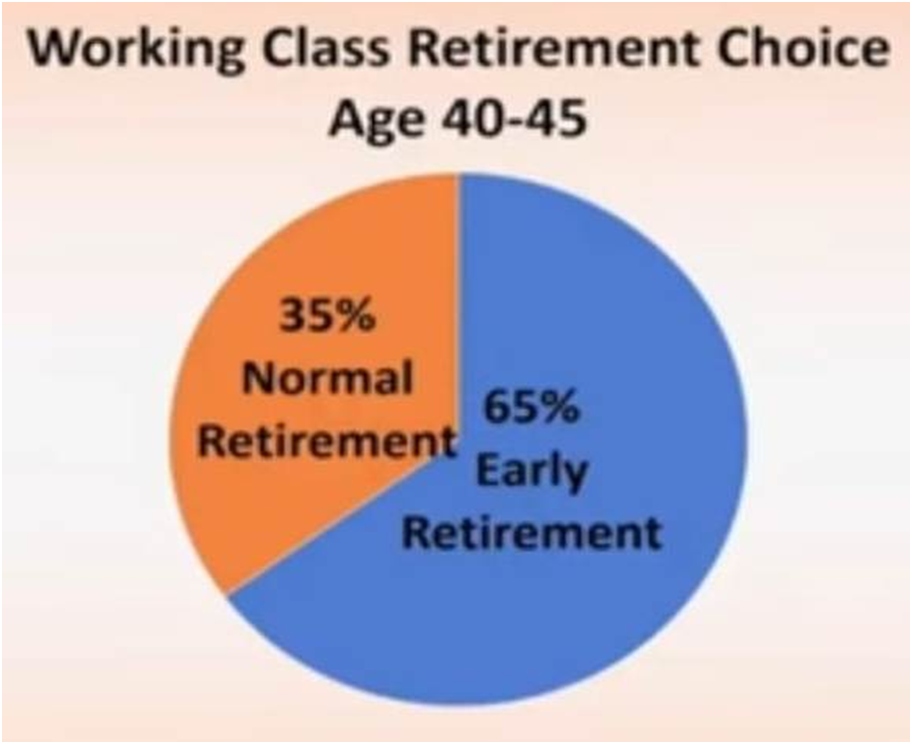

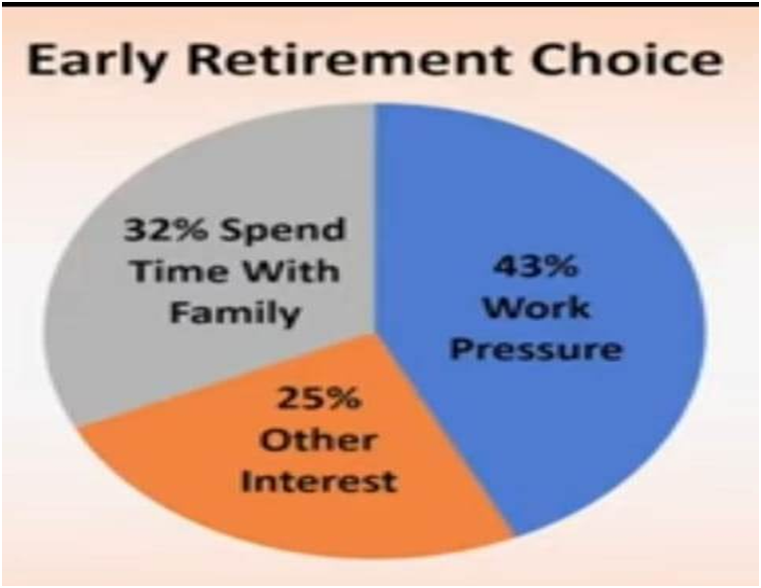

Why is Early retirement a choice?

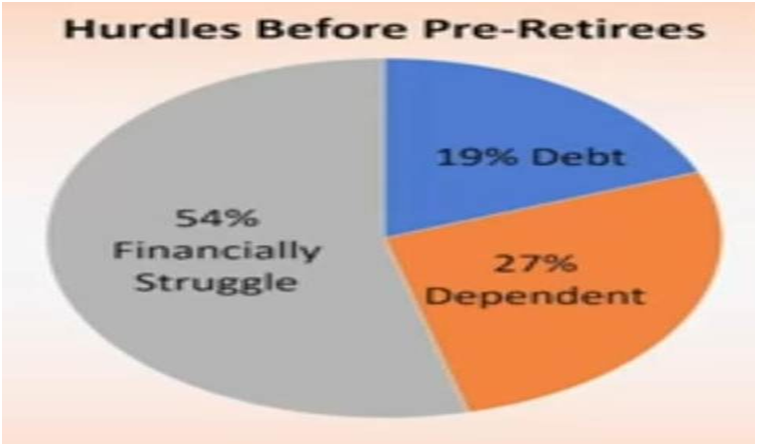

Hurdles to Early Retirement:

Funding for Retirement:

- Government

- Employer

- Self Funding

How’s your retirement planning going?

What are the sources of funding for your retirement planning?

Kindly suggest the Best retirement plan available in INDIA.