If you’ve got something of value nobody else has, there’s a good chance somebody out there will want to buy it.

“Whatever is rare, uncommon or dwindling in availability — this idea of scarcity — confers value on objects or even relationships,” says Robert Cialdini, Regents’ Professor of Psychology and Marketing.

Principle of Scarcity: According to the scarcity principle, the price of a good, which has low supply and high demand, rises to meet the expected demand. Marketers often use the principle to create artificial scarcity for a given product or good—and make it exclusive—in order to generate demand for it.

When something is in limited supply, we want more of it. When there’s less availability of something, its value and our need for it suddenly tend to go up. The more limited something is, the more it’s valued. The perceived value goes up. It’s actually really interesting.

Have you experienced 3/6 months waiting when you book a car?

Have you seen the limited version of the car?

The beginning of Washing Powder Nirma

The story begins in the year 1969 when Karshanbai Patel, a junior chemist in a government laboratory founded this small business manufacturing washing powder. He decided on the name ‘Nirma’ after the nickname of his late daughter ‘Nirupama’ who was killed in a car accident.

in 1969 detergent powders weren’t as prevalent and the ones that were present were costly. To be precise, in order to purchase a kilogram of washing powder people had to spend 13-15 rupees which was quite expensive on any scale. Most people could not afford to purchase washing powder solely due to this reason.

It was during this time that Mr Karshanbai Patel came up with the idea of a highly affordable detergent powder the Nirma. He priced it at 3 rupees per kilogram which was deemed to be the cheapest among all other detergents ruling the market and made Nirma stand out of the crowd.

The company Nirma set out on its journey to reach out to every nook and corner of the country and became a household name by 1985. The company recruited people to reach out to millions of shops across India and went ahead to advertise its product through TV ads.

The reception was overwhelming as the competitors had failed to focus on the affordability factor. Millions across the country loved Nirma washing powder and the company was on the path to profit. However, the company didn’t expect a factor that would hamper its growth toward success.

The hard time. Washing Powder Nirma was incurring an unbearable loss.

Although the reception had been very high and the company was on the path of overthrowing all other firms in the same realm, there happened an unexpected backlash which made the company rethink its customer acquisition strategy.

The resellers and shop owners that purchased the washing powder on credit weren’t willing to pay back when it was the time to do so. The company had a hard time convincing and collecting the money back. Because of this reason, Nirma experienced an unbearable loss which somehow had to be repaired.

The strategy to bring the company back to life:

Nirma decided to collect all its products circulating in the market back to its godown. Shopkeepers and resellers were asked to return the product as they had failed to make payment in time. They had no choice!

Now the company kept running its ads on print and visual media which made its presence felt everywhere. However, when people demanded the product in shops there weren’t any as they were collected back and stored in the godowns owned by Nirma!

The resellers and shopkeepers never imagined the upcoming demand for Nirma washing powder! It was overwhelming and they just failed to meet the demands. Now they had been strategically forced to knock on the doors of Nirma.

However, now the company has set a strict set of rules to sell products on credit and almost everyone had to pay upfront to get the product for their shop.

This was a crucial resurrection of the company! A must-need one!

FOMO: Fear of Missing Out: Fear of losing something is one of the foundations of value creation in marketing.

There is a saying “Fear of the Lord leads to wisdom.” Humans are more motivated to act by the idea of potential loss than of potential gain.

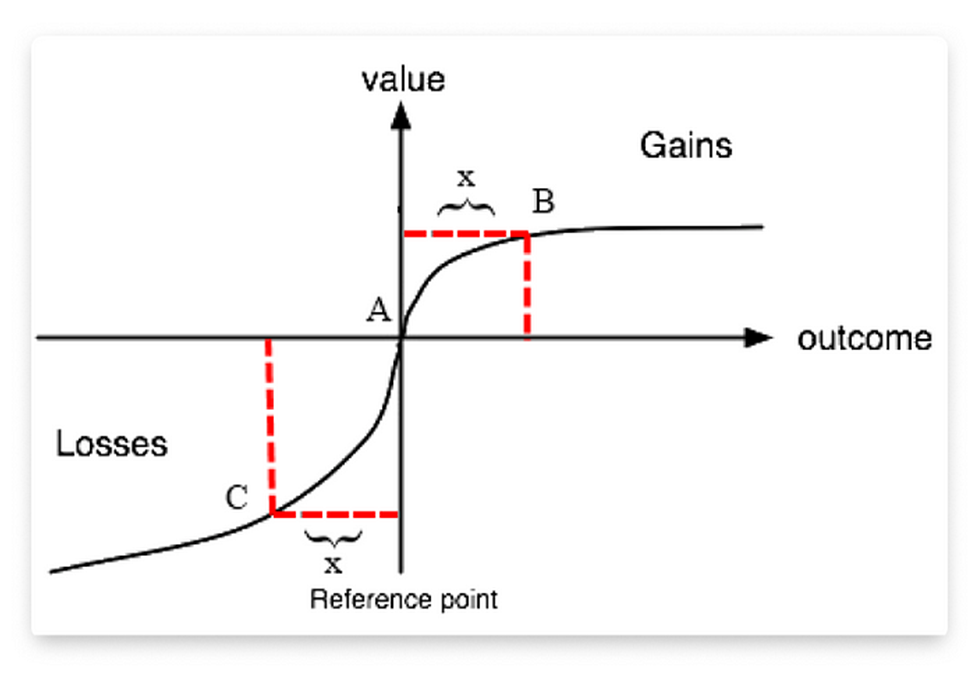

Loss aversion: is a cognitive bias that states that our fear/pain of losing something is twice as powerful as the joy of gaining the equivalent. Daniel Kahneman and Amos Tversky in research titled “Choices, Values, and Frames”. The findings express that a loss of $X is more aversive than a gain of $X is attractive.

Simply put, people fear a loss twice as much as they are likely to welcome an equivalent gain. People don’t like to lose.

Whether it’s losing a game, an argument, or an item we want to buy, we don’t like it.

In fact, people make buying decisions that are motivated by their desire to avoid a loss.

The sense of loss almost always hurts more than the joy of gain, and humans will generally tend to protect themselves from the fear of loss as opposed to ensuring the joy of gain.

“Basically what the researchers said was, ‘If you insulate your home fully, you’ll save 50 cents every day.’ That was for half of the homeowners.” Cialdini says. “With the other half, homeowners were told, ‘If you fail to insulate your home fully, you’ll lose 50 cents every day. In the end, 150 percent more people are insulated under loss language than gain language. It was the same 50 cents, but people are more mobilized into action by the idea of losing something.”

Loss aversion by insurance companies

Insurance companies rely on people’s need to feel secure and avoid risks altogether. These companies outline the risks and cost a customer might have to incur if not insured. The detailed list of the risks primes its customers to recognize the potential losses and avert them at all costs.

Additionally, with the looming fear of huge possible losses, it makes customers keep the requirement of constant small payments on the back burner, making them commit to the insurance quickly.

You must have experienced the major closing techniques of LIC OF INDIA.

Jeevan Shree POLICY in 2004?

Service tax concept in 2013!

Tax liability above 5lac premium in 2023.

1. Loss Aversion and Urgency

“Only 3 left in stock! Order now!”

“Available while supplies last.”

“Flash Sale! Today Only!”

“Don’t miss out on this awesome deal!”

We are invited, pressured, and cajoled to purchase using the fear of loss every single day. These hard-sell pressure tactics create what marketers call “urgency.”

Your marketing efforts should take these fear of loss tactics into account when planning their overall strategy.

What You Can Do

- Attach a time frame for your offer. This will motivate customers to purchase within that time window to avoid losing out on the lower price. This is typical, for example, with retail sales.

- Let people know if there is a limited number of products or service packages available at a particular price point. With the knowledge that the item or service they want may become unavailable at any time, customers will be motivated to buy now, so they don’t lose out. You can see this effect every year on Black Friday.

- Add visible count-down timers and stock notifications to your website or landing page. The visual reminders will help to encourage customers to purchase before it’s too late.

- Don’t overuse these tactics! While these tactics are effective, they are not sustainable as a stand-alone marketing strategy. If you constantly offer “limited time only” sales, people will catch on and only purchase during sales. Or worse, a constant deluge of “limited time” offers and “exclusive” deals will make customers feel lied to and manipulated. Use these tactics with restraint for maximum impact.

2. Loss Aversion and Status Quo Bias

Loss aversion can also help your business keep existing customers.

Fear of loss has a way of immobilizing people. As the old saying goes, “A bird in the hand is worth two in the bush.” We want to hold on to what we know, even if there may be something better waiting for us.

And, why do we stick with what we know? Because it’s also possible that what’s waiting for us is worse than what we already have.

Dr. Shahrah Heshmat Ph.D. explains:

…people have a tendency to stick with what they have unless there is a good reason to switch. The loss aversion is a reflection of a general bias in human psychology (status quo bias) that make people resistant to change. So when we think about change we focus more on what we might lose rather than on what we might get.

For many people, our natural inclination is to stick with what we’ve got.

But, people do brand-hop. So, what can your marketing team to do encourage existing customers to stay?

What You Can Do

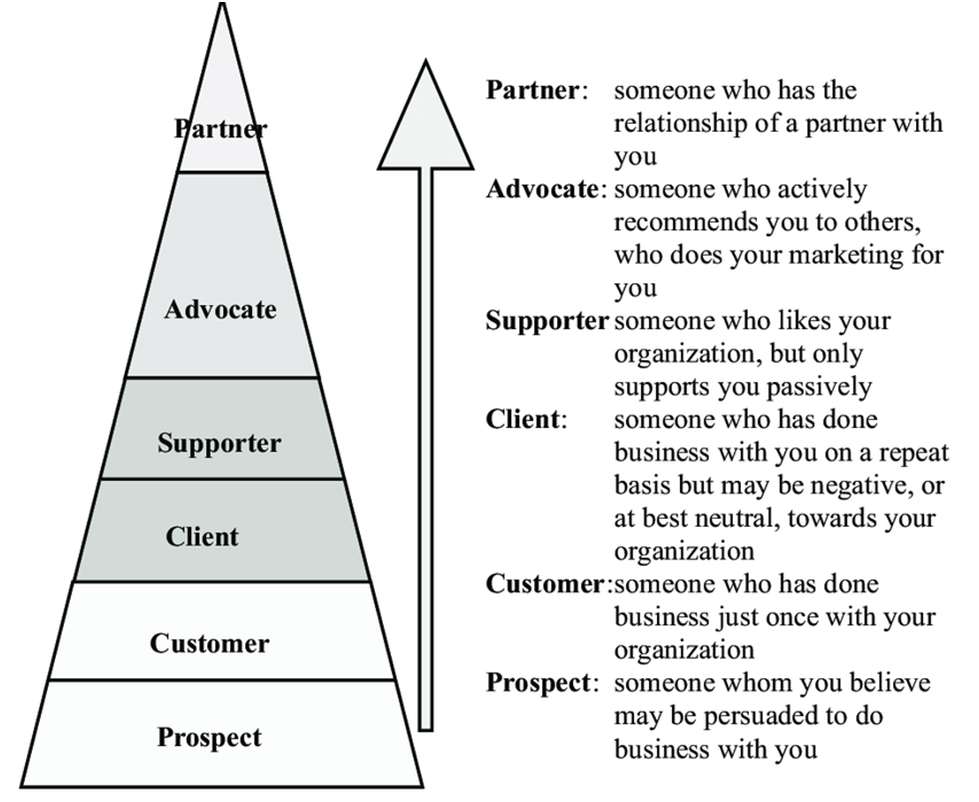

- Provide a great customer experience and customer service. Don’t give people a reason to leave.

- Find ways to remind your clients what problems your product or service solves in their lives. Customers don’t like to lose a good thing. An email campaign or social media is a great way to do this.

- Create a loyalty program that allows customers to accumulate points or status. Once people have those points or status, it will feel harder for them to leave since leaving will mean losing the goodies they’ve earned.

Loyalty ladder:

3. Loss Aversion and the Ownership Effect

People work hard to get what they have.

And once we’ve got something, we hate to let it go.

This is true whether the thing we have is actually ours or if we just think of it as ours.

At the end of the day, despite our best intentions, all people really do subconsciously think that they are the center of the universe. And, why not?

We spend our entire lives seeing the world through the lens of our own experience. We are the centers of our own little universes.

What that means is that when we see things happen to other people, we subconsciously imagine that happening to ourselves as well. So, if we see someone holding an item we think looks cool, we imagine ourselves in that role, too.

Couple this feeling of ownership with the fear of loss and it creates a powerful hook into our brains.

Magda Kay, founder of Psychology for Marketers, puts it this way:

Because we don’t like losing, once we have something, we don’t want to let go of it (and to top it even more – we value it much more). This is called the ownership effect. What it means, is that by making your audience feel they already own your product, they will be more likely to buy it- because not doing so, would mean losing it.

“When a product or object is in your hand, you have more control over it. You can turn it, look at a different side of it—you experience it more.”— Ata Jami

If you want to convert leads into sales, help them envision themselves already owning your product or using your service.

What You Can Do

- Help prospects imagine owning your product.

- Write marketing copy that suggests that your audience already owns the product.

- Show images of people happily interacting with your product or service.

- Show videos of your product being handled by other people.

- Offer a free trial or free samples, so that the prospect can directly interact with your product or service with no risk. You can do this even if you offer a digital service. For example, we allow prospective clients to freely browse active and completed design projects. Clients looking to create a new brand identity or rebrand their existing business might be interested in professional logo design and would love to see examples of other brands and logos created on crowdspring. They can easily do this by exploring other projects that have been posted on crowdspring.

- Include testimonials from other customers to which your target audience will relate. We do this at crowdspring by letting our clients and prospects look at thousands of crowdspring reviews. They can even filter the reviews by project type (like naming a business, packaging design, web design, etc.)

Loss aversion marketing can be an incredibly effective tool in your marketing repertoire. Be sure to test some of these tactics in your overall marketing strategy.

Kindly share your experience in the comment box of using this principle in marketing your products or services.