Insurance Advisor in LIC OF INDIA.

Who is a life insurance Agent?

FBI agents . . . secret agents . . . life insurance agents. Okay, insurance agents might not be up there in the world of international espionage. Does Sachin Tendulkar have life insurance? If he does, you can bet he got an insurance expert to find the best deal for him!

In the complex world of life insurance, having someone on your side who knows the industry is always a good thing. An agent is in the best position to find you the ideal life insurance policy for you—whatever your situation.

So who is the best life insurance agent?

The one who’ll save your time and money.

Life insurance agents are licensed professionals who sell life insurance policies. They will work for an insurance company and sell policies “carried” by that insurance company.

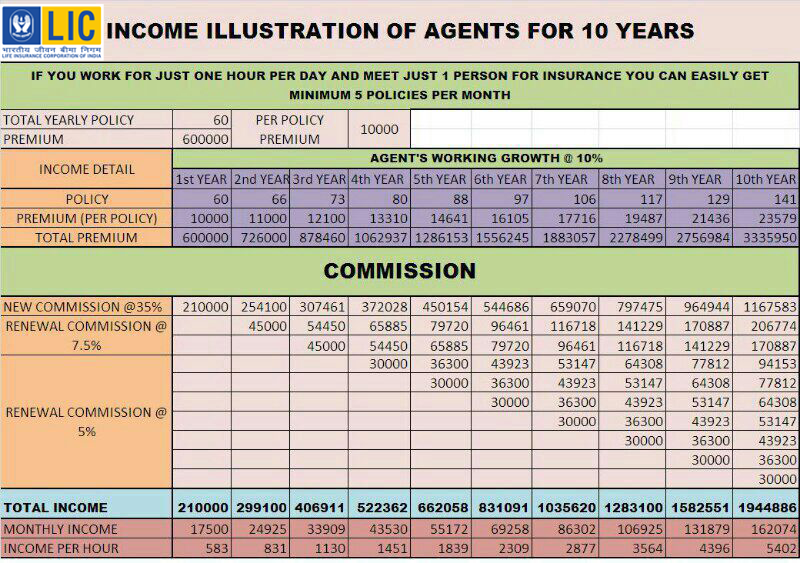

#The Closing: You are closing for a company meaning you are working as a commission-based salesperson. Now I’m not talking about working door to door, this is a 20th-century method of marketing, although you could do that but a commission-based closer or salesperson you are working on commission, meaning let’s say you sell life insurance for 300000 and get a 35% commission you are making a 105000 per sale, in some cases you doing on the phone!

Believe me, it’s one of the most highest-paid professions in the world. You can make an incredible income without a lot of credentials without that degree and you can do that in your spare time.

Because companies, they are paying on the results and when you get paid based on the result there is no limit to how much you can earn. If you want to know more about how to make as a CLOSER, we have 1-day training that is absolutely free. The no. 1 side hassle that you could do is a CLOSER because it gives you the highest leverage with the least amount of work and something you could understand and learn in a very very short period of time. We have people who are earning from 10,000 -1,00,00,000 per month.

”Make more money. Part-time with full-time effort”

THE NOBLEST PROFESSION IN THE WORLD

If you are in the financial services business or contemplating becoming a financial service professional, you should know that it is the noblest profession on earth. It is true. The insurance industry deals with the defining issue of the 21st century—not energy, global warming, or terrorism—it is the aging population of the world.

Human beings have never lived this long. Did you know that there are five nations—China, India, the United States, Indonesia, and Brazil—that have at least 50 million people over 60 years old? And that this group is growing five times faster than any other cohort. The days are not so far when we will witness the more sale of an adult diaper than a baby diaper.

“Longevity Tsunami” is overwhelming traditional benefits and entitlements of governments and corporations. On a global level, governments, companies, and centuries-old cultural practices of caring for senior citizens are breaking down. The end result is that people are on their own. Therefore there is a desperate need for financial professionals to help people assume the responsibility of self-reliance. The insurance, or protection, the industry is uniquely positioned to deal with this issue. Originally, the business was founded on the premise of protecting people from dying too soon. Now it can provide people with independence and dignity while living longer.

LIFE OF SIGNIFICANCE

Intrinsic value is not measured by how much money you make, but by the size of the problem, you can solve. The insurance industry offers financial services dealing with the major human issues of our time:

- You provide peace of mind (Keeping a business or family going) when people die prematurely.

- You provide people with a worry-free retirement with a tax-free guaranteed regular income for lifetimes, they can’t outlive so they can maintain their independence.

- You can protect that income if they get sick or disabled so that they maintain their dignity.

- And finally, you provide a legacy when they die.

These are the human issues of our time and what the business of financial services is all about. Our job is about the people we serve. Not just how you can enrich yourself, but how you can fulfill yourself. If you are in the business to provide critically needed help to those who have been abandoned by governments, corporations, and their most loved ones, you will live a life of significance.

By helping people enjoy independence and dignity in their lives, your career will be blessed with enrichment and fulfillment. It won’t be easy, but it will be infinitely more rewarding than just doing it for the money.

In this noble profession, you must not focus on what you want(corporate, personal goals) and how you get what you want (knowledge, skills, strategy), but on why you do.

If you know your “WHY”, you can do it any “HOW”.

Top Insurance Advisors and their Earnings

You get an opportunity to work in a flexible hour and become financially independent. you also get recognition across the multiple fora

Regardless of who you are, there is DEFINITELY an unsung melody in you that people do not know about yet. There is a message that hides behind your years of experience, and this is to bring that forward. That is why I would like to invite you to participate to become Insurance Advisor.

The Benefits :

The Benefits :Here’s a list of 9 unique benefits available to insurance agents:

1. Start Earning at the Age of 18

One advantage of becoming an insurance agent is the ease of entry; most agents need to have completed only secondary school. Right after completing your 10th, you can become an insurance agent. All you need is love for the thrill of the hunt, the rush of a sale.

You get the learning and earning opportunity. Once you complete 5 years of your agency and complete your graduation you have a 25% reservation in a government job. You will be eligible to apply for the Apprentice Development Officer post in LIC OF INDIA.

2. Be Your Own Boss

If you have entrepreneurial inclinations and a passion for building your own business, perhaps you should try and become an insurance agent. When you work for yourself, you can work as per your schedule and also develop your own system for attracting and developing clients. The more you invest your time and resources, the more returns you can expect to get. You only need to have the right mindset to sell insurance in a rightful manner.

3. Build a Stable Income and Control the Growth

The industry offers huge untapped earning potential, and once you become an agent, your income is only limited by your desire. Because of under-served insurance markets, there is always this opportunity of earning more with a little more effort.

The best part is your one-time effort can build a long stream of cash flows, which can be maintained with minimal service efforts. Once you sell the policy, the earning doesn’t restrict to the first year only. You will earn on the policy renewal as well, which can easily go up to 30 years. Thus, over a period, your regular income stabilizes, and every additional effort only increases your income further.

4. Zero Investment Required

The only investment that you need to do is your time and effort. There is no upper cap on the income that you can generate.

5. Flexible Work Timings

Most office jobs require their employees to be at their desks at 9 am in the morning and must sit through the day till 6 pm. However, insurance agents have flexible working timings. As an insurance agent, you can choose to work at your convenience or also establish your own office away from home.

If you are a homemaker, you can use the opportunity to become financially independent and contribute to your household income. Similarly, retired people too can create an additional income stream as an insurance agent by helping people understand and buy insurance plans. This also works as a great source of part-time income, for people who are already occupied with other jobs.

Once you become an agent for LIC OF INDIA, you can choose the time and place you’d like to work.

6. Make a Difference in People’s Lives

Do you think that only professions like doctors and teachers can positively impact people’s lives? Insurance agents are equally rewarded as their work helps people to build assets, take care of child education, transfer wealth from one generation to the next, plan for retirement and much more.

The LIC OF INDIA offers you a golden opportunity to make a difference in people’s lives and society. Insurance is that economic instrument that saves families and businesses from falling into the vicious cycle of poverty.

As an insurance agent, you can change lives, and this feeling itself is greatly satisfying and should keep you in high spirits.

7. Learn from Industry Experts

Once you become an agent of a reputed insurance company, you get a lot of opportunities to develop your personal and professional skills through expert-led training programs. The training may include classroom instruction, field exposure, and one-on-one coaching.

The industry is keen on imparting training and development support to their agents, and thus, they provide additional training, organize seminars/workshops to help them learn more and network with other people. Once again as an insurance agent, you have a choice to learn from the best in the industry and keep yourself updated with the latest events.

8. Say Good-Bye to Paper Workin the Digital World: The Ananda Module:

Gone are those days when agents used to carry loads of brochures and policy documents to meet clients. Nowadays, you have all brochures and application forms available at your fingertips. As a modern insurance agent, you can simply carry a laptop or a tablet to present your insurance plans to your prospects and complete the formalities for customers.

Even there is no need for a fat scheduler as you can use tablets (and even your smartphone) to manage leads, schedule appointments and explain products to the customer and issue the policy then and there.

9. Rewards & Recognition

You get an opportunity to experience various national & international recognition forums as an insurance agent. For example, Asia’s Trusted Life Insurance Agents and Advisors, and Million Dollar Round Table(MDRT) memberships are a few big recognition forums for life insurance agents. Qualifying for these awards could be rigorous but, can also project the agent on the international stage. For instance, Asia Trusted Life Insurance Agents and Advisors witness participation from six Asian countries— China, Hong Kong, Malaysia, India, Taiwan, and Singapore (Source: Asia Trusted Life Insurance Agents and Advisors).

While your commission earnings are always there, these awards and recognitions are a cherry on the cake.

In a nutshell, if you are looking for careers where you can be your own boss, define your income by yourself, and help people build a financially stable future, becoming an insurance agent could be the thing for you.

How Do Life Insurance Agents Get Paid?

Insurance agents make their money through commissions from a percentage of the premium itself. Don’t worry—you’re not hit with a bill immediately after you’ve bought a policy! The insurance company you’re buying your insurance from will pay them the commission.

The more life insurance policies an agent sells, the more they’ll make in commissions. Independent agents are usually only paid from commissions.

Club membership and its benefit:

The Agent to follow a simple formula for 3 years only. To Qualify for the Membership:

BM Club – Just 4/5 Lives every month (1 Life/Week)

DM Club – Just 7/8 Lives every month (2 Lives/Week)

ZM Club – Just 8/9 Lives every month (1 Life/3 Day)

CM Club – Just 11/12 Lives every month (1 Life/2 Day)

MDRT – Rs.200000 FPI Every Month

About MDRT

Founded in 1927, the Million Dollar Round Table (MDRT), The Premier Association of Financial Professionals®, is a global, independent association of more than 49,500 of the world’s leading life insurance and financial services professionals from more than 500 companies in 70 countries. MDRT members demonstrate exceptional professional knowledge, strict ethical conduct, and outstanding client service. MDRT membership is recognized internationally as the standard of excellence in the life insurance and financial services business.

What is Club Membership?

- Recognition for meritorious agents•

- Performance reward•

- Financial & Non-Financial motivator•

- Inducement for higher performance

What are the Clubs?

- Corporate clubGalaxy club.

- Chairman’s Club•

- Zonal Manager’s Club•

- Divisional Manager’s Club•

- Branch Manager’s Club•

- Distinguished Agents Club

Distinguished Agents Club

- First Step in Club Membership

- Any Agent who has completed 1-year service will be eligible

- Minimum Net Lives: 40

- Minimum First Yr Comm: Rs.50,000/-

BM Club :

- Minimum number Of lives: 15

- Net number Of lives:50 or net number of lives inforce:150

- renewal commission Paid: 50,000

- First year commission: 35000

Benefits:

- Stationery and Office allowance: Rs 1000

- Sales promotion and gift items: Rs 500

- Festival Advance: 15000

- Letter heads with envelopes: 300 per year

- Visiting Cards: 100 per year

- Attestation of Age Proof: NA

- MHR limit:10 lac

- LIC Guesthouse: yes

- Interest free Vehicle advance: two wheeler only

- Housing Loan: NIL

- Telephone Facility: Rs 1800 per year

- Group mediclaim: Rs.100,000

- Group term insurance: 55000

- Conventions: 2nd Ac Train Fare + Rs.200 per day

DM Club

- Minimum number Of lives: 20

- Net number Of lives:80or net number of lives inforce:250

- renewal commission Paid: 95000

- First year commission: 63000

Benefits:

- Stationery and Office allowance: Rs 12000

- Sales promotion and gift items: Rs 1000

- Festival Advance: 20000

- Letter heads with envelopes: 500 per year

- Visiting Cards: 150 per year

- Attestation of Age Proof: yes

- MHR limit:20 lac

- LIC Guesthouse: yes

- Interest free Vehicle advance: two-wheeler only

- Housing Loan: 9 LAKHS Cadre Loan @5% + 11 lakhs Extended @9.5%)

- Telephone Facility: Rs 2400 per year

- Group mediclaim: Rs.150,000

- Group term insurance: 110000

- Conventions: 2nd Ac Train Fare + Rs.400 per day15.furniture Advance:35000

ZM Club

- Minimum number Of lives: 30

- Net number Of lives :100or net number of lives inforce:400

- renewal commission Paid: 147000

- First year commission: 147000

Benefits:

- Stationery and Office allowance: Rs 22000

- Sales promotion and gift items: Rs 2000

- Festival Advance: 20000

- Letter heads with envelopes: 750 per year

- Visiting Cards: 200 per year

- Attestation of Age Proof: yes

- MHR limit:30 lac

- LIC Guesthouse: yes

- Interest free Vehicle advance: up to 500,000/-

- Housing Loan: 25LAKHS, { 11,25000/@5%, + 13.75000/-@ 9.5%}

- Telephone Facility: Rs 4000 per year12.Group mediclaim: Rs.200,000

- Group term insurance: 200000

- ZM Club Member – Rail Fare I class/II tier AC/III Tier AC sleeper Fare and out of pocket expensesRs. 1800

CM Club:

- Minimum number Of lives: 40

- Net number Of lives:130or net number of lives inforce:600

- renewal commission Paid: 210000

- First year commission: 210000

Benefits:

- Stationery and Office allowance: Rs 35000

- Sales promotion and gift items: Rs 3000

- Festival Advance: 20000

- Letter heads with envelopes: 1000 per year

- Visiting Cards: 250 per year

- Attestation of Age Proof: yes

- MHR limit:50 lac

- LIC Guesthouse: yes

- Interest free Vehicle advance: CM Club Max of 6 Lakhs (or) last 2 years Renewal commission

- Housing Loan: 40LAKHS, { 18.50 LAKHS@ 5%, + 21.50LAKHS@ 9.5%}

- Telephone Facility: Rs 6000 per year

- Group mediclaim: Rs.300,000

- Group term insurance: 400000

- CM Club Member – Economy class Air Fare/II tier Ac/III tier AC sleeper Fare & out of pocket expensesRs. 3000/-

Galaxy Club: (MDRT)

Eligibility criteria for the Entry and Continuation in the club shall be fixed year by the Central Office. The requirement in the qualifying year (2014-15): First Year Commission 10 lakh (without Bonus commission) OR First-year Premium 40 lakh (In case of Single premium 6% credit will be given for First-year premium)

Benefits:

- Main: Not clubbed with Fringe Benefits of any club.

- Car Advance: Rs.10 Lakhs

- Office Allowance: 50% of Actual Expenses or Rs.1,00,000 whichever is lower)

- Telephone Charges : Rental + Calls Rs.12,000 per year

- Letter Heads and Envelopes: 500 per year

- Visiting Cards: 500 per year

- Conventions: Airfare up to Rs.60,000 to attend MDRT meet / MDRT Experience meet + Rs.10,000 out of pocket expenses for MDRT meet

- Blazer: Rs.5,000 once in 3 years

- Other Benefits: Same as C.M. Club member10.Group term insurance==6 lakhs.

- Mediclame = 4 lakhs.

- Housing loan===50 lakhs,{ 21.25lakhs+ 28.75lakhs}13,Festivel adv,==22000/-

Corporate Club:

18 lac First Year Commission (excluding Bonus) in the year 2016-17 and 2017-18.

Benefits:

- Stationery and Office allowance: Rs 125000

- Sales promotion and gift items: Rs 500

- Festival Advance: 30000

- Letter heads with envelopes: 1500 per year

- Visiting Cards: 1000 per year

- Attestation of Age Proof: NA

- MHR limit:10 lac8.LIC Guesthouse: yes

- Interest free Vehicle advance: Rs 30,00,000/-

- Housing Loan: 60 lakhs. 28lakh @5% and 32lakh@9.5%}

- Telephone Facility: Rs 15000 per year12.Group mediclaim: Rs.500,00013.Group term insurance: 800000

Benefits to ALL AGENTS:

CAR LOAN & QUANTUM*:

- CM Club Max of 6 Lakhs (or) last 2 years Renewal commission

- ZM Club Max of 5 Lakhs (or) 75% of last 2 years Renewal commission

- DM/BM Club Only 2-Wheeler Advance*Interest-free for CM/ZM & 9% for other Agents – Repayment in 96 months

Two Wheeler advance & quantum•

Same as Car Loan•Interest-free to Club Members•9% to other Agents 60 Months recovery from the commission

Office Equipment:

- All Club Members are eligible

- Advance up to last year’s Renewal Commission•Interest-free to Club Members

- 9% interest to other Agents 36-months recoveryCan be availed 5 times in LIFE.

Medical Treatment of self/family

- Available to Club Members/ERC only

- In case of SERIOUS illness, advance equal to last year’s RENEWAL.

- Hospital Bills etc to be produced 9% interest & 36 months duration

Marriage of self/family:

- Available to Club Members/ERC only

- Advance equal to last year’s RENEWAL.

- Proof of marriage etc. to be given at 9% pa for 36 months

Religious ceremonies:

- Club Members/ERC Agents only

- Last year’s RENEWAL or Rs.25,000 whichever is minimum at 9% interest for 36 months

- It Can be availed 3 times in LIFE.

Flood/Drought Advance:•Club Member Agents/ ERC Agents•Interest-fee recoverable as per notification Repairs to Car/Bike:Quotations from Garage•Upto Rs.20,000 for Car•Upto Rs.10,000 for 2-Wheeler at 9% recoverable by 36 installments

Festival Advance:•For Agents > 5 yrs : Rs.8,000/-Agents 2 to 5 yrs : Rs.5,000/-* Recoverable in 10 instalments

Training Advance:•Maximum amount of Rs.7,500/-•Interest-free repayment in 10 months Any Agent who has completed 5 years of Service is eligible

Gratuity to Agents:•Every Agent is eligible for Gratuity•Completed 15 years of service•Should have attained 60 years•Gratuity is eligible for any Agent who has left the service of LIC provided 15 years of service is completed maximum eligible – Rs.2,00,000 increased to 3,00,000/-

Group Insurance:•For all Agents with min 1-yr service•With effect from 1.9.07•Agents up to Age: 65 covered•A very nominal premium is recovered from Commission during September. It is a Boon to all AGENTS of LIC agents.

Group Insurance Details:

Service—-Risk Cover—-annual premium1 to 3 years–50000——-1203 to 5 years–100000——2405 to 10 years–300000—–720

above 10 years–500000—–1200

Group Mediclaim for Club Member Agents policy year 2018-2019for club member agency year (2017-2018)

policy no. 12030034180400000011New India Assurance Company

Corporate Club 500000Club Galaxy 400000Chairman’s Club 300000Zonal Manager’s Club 200000Divisional Manager’s Club 150000Branch Manager’s Club 100000

So why go anywhere TRUST THY NAME LIC OF INDIA. How you make others protect their finances against uncertainty.: Most people are so intent on investing and building assets that they forget to cover their risks. Since it’s crucial to secure their family and finances by creating an adequate insurance portfolio, You make them realize.